LHC Strength Flaccid Next Program

The latest Orleans Work environment away from Area Advancement has the benefit of appealing gives so you’re able to first-time homebuyers in the Louisiana. Due to its program, buyers is safer around $55,000 as an extra home loan using one-family members residence together with a supplementary $5,000 for closing costs – appeal and you will payment-totally free. Unlike a timeless mortgage, it is a good forgivable grant whether your property functions as new recipient’s number 1 quarters for 10 years.

To the basic-date domestic client Louisiana certification, the brand new applicant’s household income need to slip lower than 80% of your region’s Average Urban area Income. Recognition of a first financial through someone lender is even required. Completing an information applied of the groups including the HUD Property Counseling Agency cycles from the conditions.

FHA Funds

A keen FHA financial, insured through the Government Property Management, serves individuals with incomplete credit records otherwise exactly who don’t fulfill practical financing official certification. Such as for instance finance is also fund both the buy and design away from an effective domestic. Due to the fact authorities guarantees such mortgages is actually facing default, he or she is obtainable compliment of main banks and you may independent loan providers recognized in order to question FHA-recognized selling.

Va Finance

Virtual assistant home loans stand due to the fact another important option for productive armed forces team or veterans which meet the requirements. Guaranteed in auspices of the United states Agency off Pros Factors, such mortgages helps the acquisition regarding a primary household. Numerous gurus match Va funding, eg not necessitating off repayments or personal mortgage insurance policies. In addition to this, the eye pricing associated generally speaking undercut fighting now offers. You to receives an effective Va mortgage right from a lending company, not the brand new Va by itself.

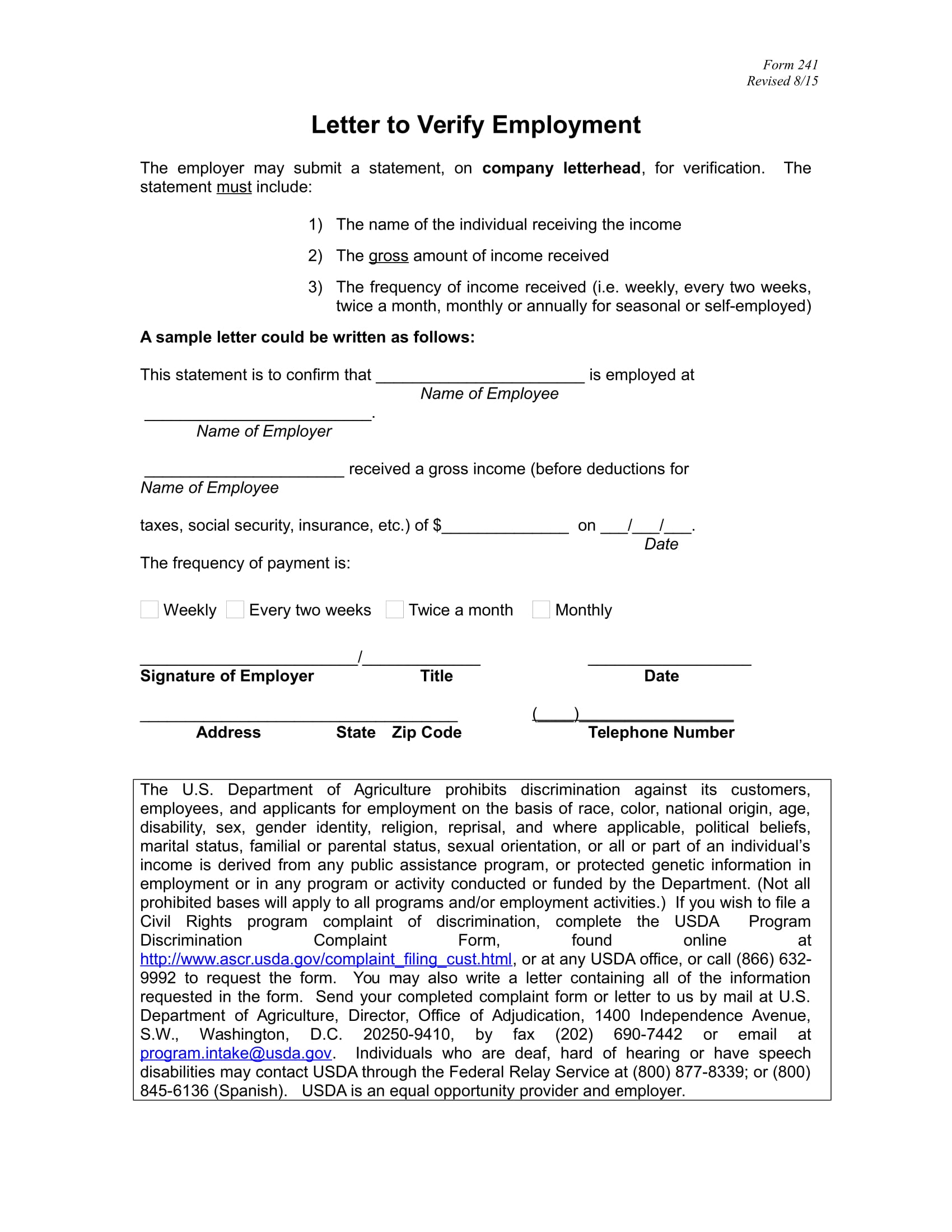

USDA Fund

Intended for earliest-day consumers during the designated outlying pieces, the us Company regarding Agriculture brings funds requiring no down commission. Designed for reasonable-to-moderate income individuals failing continually to meet old-fashioned financing prerequisites, this type of mortgages use money ceilings changing by location. At exactly the same time, upfront and you will annual can cost you tie in which have an excellent USDA financing instead out of a basic financing.

Introduction regarding a course on this web site does not create a keen affirmation of the Overall Mortgage and will not make sure your qualification or acceptance towards the program.

Financial rates was erratic and you will at the mercy of alter with no warning. All rates found are to have 30-time rates hair with two and a half affairs having a single cashadvancecompass.com/personal-loans-ma family relations owner-occupied number one home that have 750 or more FICO and you will 80 LTV more than a thirty-12 months loan name except in which if you don’t listed and tend to be susceptible to financial acceptance that have complete documentation of money. The fresh new Apr to possess a thirty-year and you can fifteen-year antique fixed-speed mortgages are calculated having fun with an amount borrowed away from $360,000, two and a half factors, an effective $495 software fee, $450 appraisal commission, $1,195 underwriting payment, a great $ten flooding qualification payment, and you will a $82 credit file payment.* 15-12 months traditional mortgage costs was determined having an effective 15-year financing label.* The fresh Apr for jumbo financial pricing is actually calculated playing with a loan level of $five hundred,000, two-and-a-half factors, a good $495 application fee, $450 appraisal commission, $step one,195 underwriting percentage, $10 ton qualification payment, and you will a beneficial $82 credit history commission.* Brand new Apr for FHA mortgage pricing is actually computed playing with financing number of $360,000, two-and-a-half activities, a great $495 software percentage, $450 assessment fee, $step one,195 underwriting payment, $10 flood certification percentage, and you can good $82 credit report payment. Certain rates and you will costs can vary of the state.* The newest Annual percentage rate for variable price mortgages (ARMs) is calculated using an amount borrowed from $360,000, two-and-a-half facts, a beneficial $495 application fee, $450 appraisal payment, $1,195 underwriting fee, $ten ton degree commission and you will a beneficial $82 credit report payment. Specific prices and you can charge can vary by the condition. Products are at the mercy of access towards the a state-by-county base. From the refinancing your current financing, your full finance costs may be highest across the life of the borrowed funds.

Income certificates with the Financial Funds Bond Domestic system require money during the or below 80% of one’s town median money. To the Aided alternative, money can range regarding 115% so you’re able to 140% of one’s town median income, with regards to the loan type of, domestic proportions, and you may whether the home stays in a specific area.