Not Researching Loan providers and you will Things

A common mistake isnt thoroughly contrasting prospective lenders and you can affairs before making a decision. Failing to examine interest rates, charges, and you can conditions from multiple lenders could cause home owners at a disadvantage with the high discount or maybe more advantageous loan terms and conditions.

Underestimating Associated Will cost you

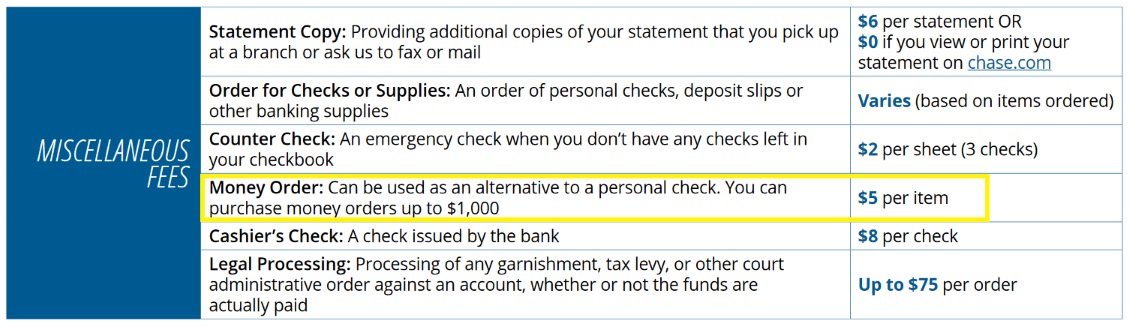

Another type of well-known error isnt considering all the related can cost you of refinancing. Plus interest rates and you will monthly premiums, home owners should be aware of possible charge for example app fees, courtroom charge, valuation charge, and early payment fees. Failing continually to account for such will cost you you may impact the full monetary advantage of refinancing.

Maybe not Expertise Loan Conditions and Aligning with A lot of time-name Wants

Also, specific property owners make the mistake off maybe not totally knowing the conditions and you may standards of your own new financing before you sign to your dotted line. It is crucial for residents to carefully comment most of the financing data files which have legal professionals otherwise financial advisors to ensure that it grasp its debt and you will rights according to the the fresh new loan arrangement. Simultaneously, some homeowners could make the brand new mistake from perhaps not offered their much time-name financial wants whenever refinancing. It is vital to determine if the the fresh financing aligns which have one’s complete economic method and if this can assist go specific wants eg settling personal debt less or opening security for other expenditures.

With respect to making informed choices on the refinancing a mortgage inside The Zealand, homeowners need to cautiously consider the benefits and you will cons out of Diy refinancing in place of playing with a mortgage broker. Diy refinancing also provides possible cost savings and you can full command over brand new procedure but needs significant time and effort for residents. At the same time, having fun with a large financial company brings usage of expert recommendations and you may a wide range of loan providers but may come with related charge and you can potential conflicts of great interest.

Sooner, the option between Diy refinancing and ultizing a large financial company often believe individual items such as financial studies, go out accessibility, access to information, and you may comfort level having navigating the latest state-of-the-art field of mortgage refinancing. Residents More about the author would be to carefully evaluate these circumstances before making a decision that aligns using their enough time-name monetary desires. To summarize, and then make told choices in the Diy rather than having fun with a mortgage broker to possess refinancing a mortgage inside the The fresh new Zealand need careful consideration of private points and weigh the possibility pros and cons of each and every option.

Performing thorough look and seeking professional advice if needed, residents renders convinced decisions which can in the course of time rescue all of them money and you will make with the economic wants.

If you are considering mortgage refinancing inside the Brand new Zealand, you are questioning even though need a broker in order to from processes. An associated overview of Fundmaster’s webpages, Top vs. Strolled Premium: Highlighting into Advantages and disadvantages, covers the huge benefits and you will downsides of different premium structures to own insurance coverage principles. This particular article can provide rewarding insight into the advantages and you may drawbacks of using a brokerage getting refinancing mortgage, working for you create an educated choice in the whether or not to find professional assistance.

What exactly is mortgage refinancing?

Mortgage refinancing involves replacement a current financial with a special you to definitely, generally for taking advantageous asset of lower interest levels, get rid of monthly obligations, or accessibility security yourself.

Manage I need a brokerage having refinancing mortgage into the NZ?

Even though it is perhaps not required to utilize a broker having home loan refinancing from inside the NZ, people will work on an agent to greatly help browse the process and acquire a knowledgeable package.

Which are the gurus of employing an agent to own mortgage refinancing?

Agents get access to many lenders and certainly will help you find an informed deal for the certain finances. Brokers can save you efforts by-doing the research and you can records in your stead. Brokers also have qualified advice and you may pointers about refinancing techniques.