Extremely mortgages possess an escrow account on the all of them

Escrow is actually a legal arrangement where individuals retains a monetary advantage from a (typically currency) up until specific criteria is satisfied, and then the asset arrives.

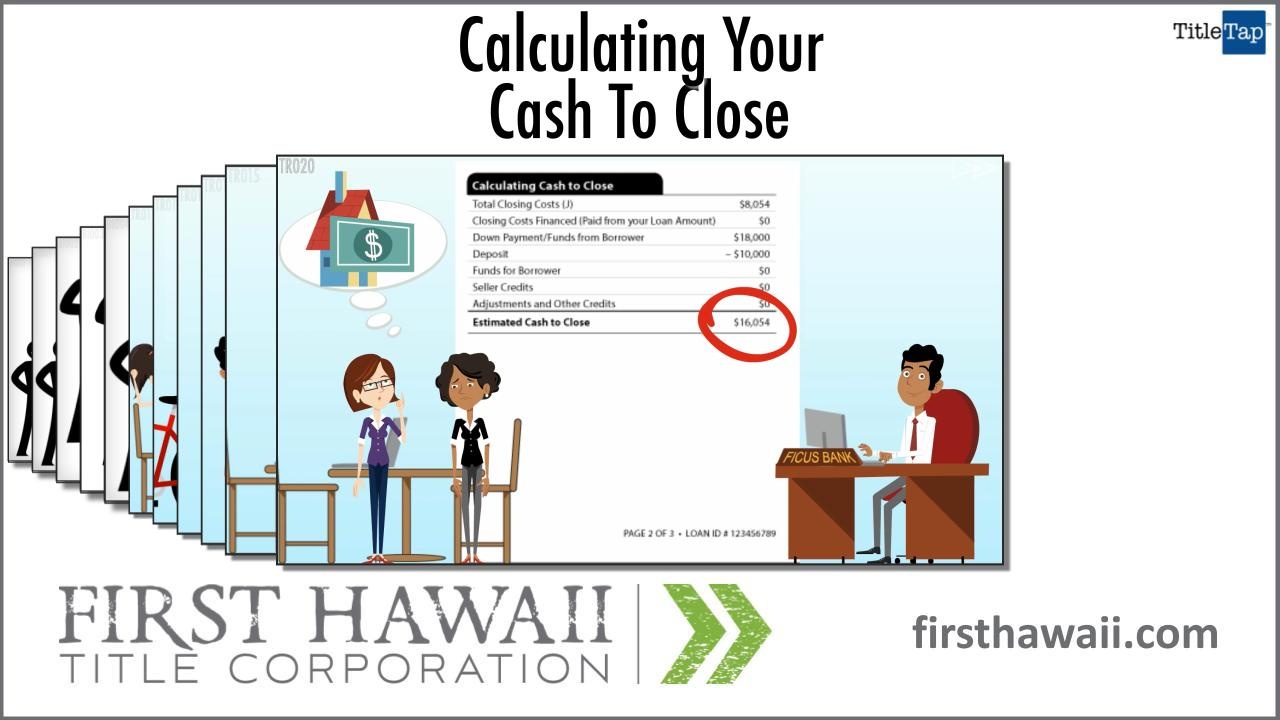

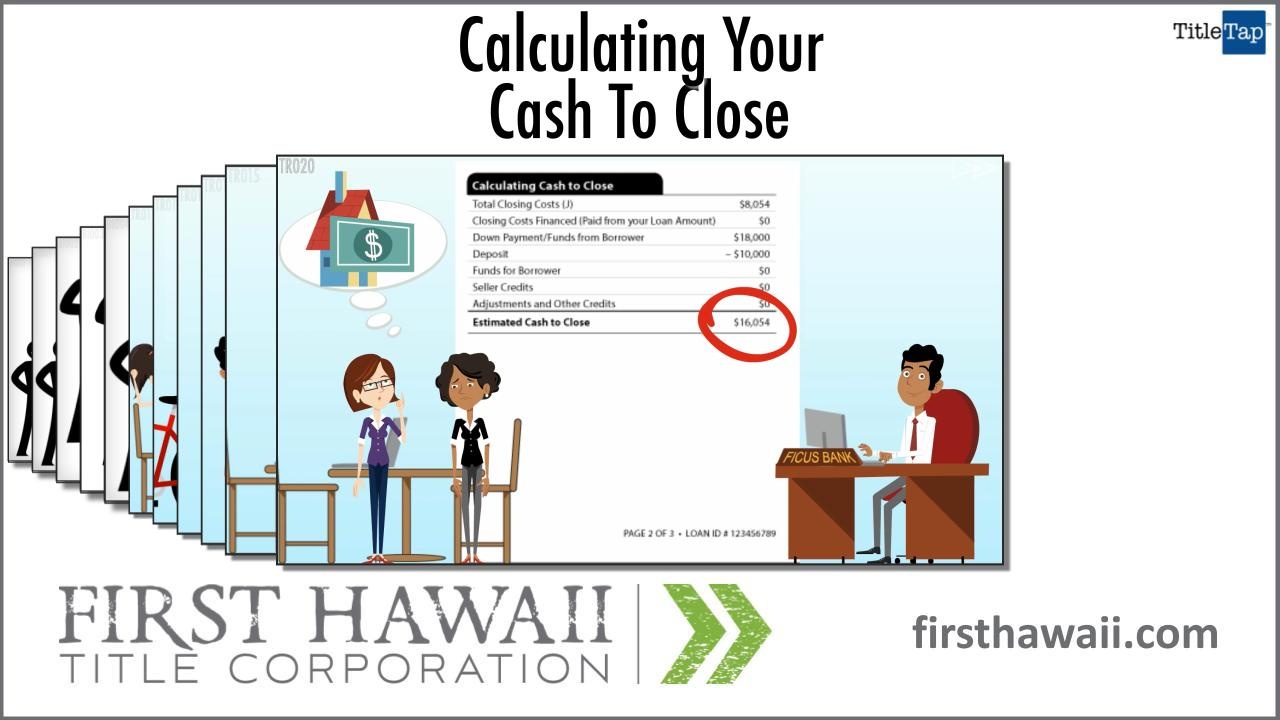

Loan-origination escrow is when a third party, for example a subject organization otherwise an attorney, retains good nonrefundable earnest-currency deposit for your requirements during the means of to acquire a home. Since profit experience, that cash could be used to the the brand new advance payment.

Loan-upkeep escrow was a long-label membership that we take care of to you personally from the life of your real estate loan. Once you create home financing fee monthly, we lay several of you to definitely fee in the escrow account and you may use it to pay for your property fees and you may homeowners' insurance policies bills. This is the kind of escrow we're going to explore in this post.

I create escrow makes up much of all of our consumers. The newest conditions is actually consumers just who paid off 20% off or even more when they bought their property, and you will selected not to have an enthusiastic escrow account.

You deposit money in your escrow account monthly once you shell out your mortgage. We contain the currency for you, then withdraw the amount of money when it comes time to pay for possessions taxation and you will home insurance.

In a few claims, other property-related can cost you particularly HOA fees or private home loan insurance costs is repaid from the escrow account. See your mortgage price to own home elevators what's found in your account.

I do it of the emailing your a should you get your own escrow data letter

For those who have an enthusiastic escrow account, you don't have to consider budgeting to have a giant possessions goverment tax bill otherwise protecting upwards for your insurance fee. People significant expenditures was divided into smaller chunks you are currently purchasing when you make your monthly homeloan payment. (さらに…)