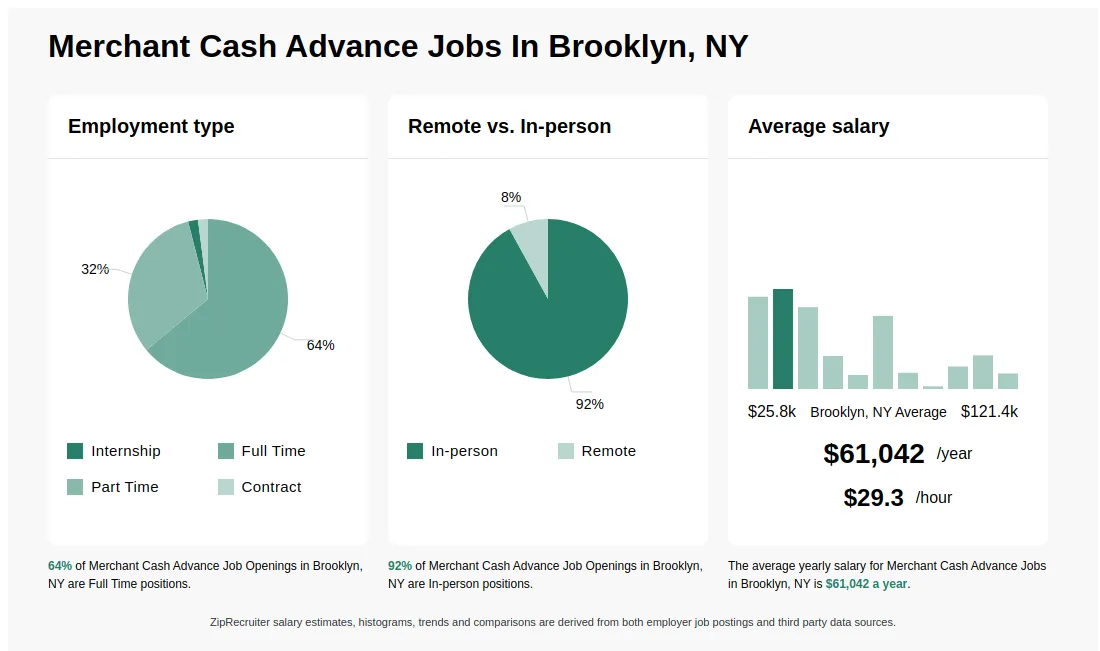

advance cash bank

Learn more: Why and the ways to carry out a finances-away refinance

Re-finance rates are not best for of numerous individuals currently, with pricing however much higher than historic lows for the pandemic. However, for people who has just bought a property and you will locked inside a speed between seven and 8 %, you can find a way to re-finance so you can a lesser speed inside the 2025.

If you've possessed your house for some time, maybe you have a whole lot more house equity collected now, particularly having how home values have raised. If you want money to-do other goals, for example family renovations, you could potentially leverage one guarantee that have a money-aside re-finance.

Oklahoma mortgage rate trend

Despite the Government Put aside reducing brand new federal funds rates three times in a row, 30-year home loan rates across the nation enjoys increased, exceeding seven per cent at the beginning of 2025. When you are mortgage pricing are difficult in order to anticipate, of many Massachusetts personal loans economists predict rates in which to stay the latest 6 so you're able to 7 percent diversity throughout 2025, adopting the a short-term increase more than eight %.

Highest home loan rates and you can expanding home prices continue steadily to generate affordability an issue for the majority Oregon people. The median house sales price from inside the Oklahoma is $230,000 into the , upwards 7 % in place of the year earlier, considering ATTOM. not, even after you to definitely improve, Oklahoma a residential property prices are still really less than national averages. The brand new federal median house speed is actually $406,100 since , according to Federal Connection out-of Real estate professionals.

Federal mortgage cost by the loan style of

- Purchase

- Refinance

How Bankrate's prices is calculated

- Right-away averages: I determine every day quickly rate averages to your individuals items away from numerous financial institutions. (さらに…)