Understanding Pocket Option Indicators: A Comprehensive Guide

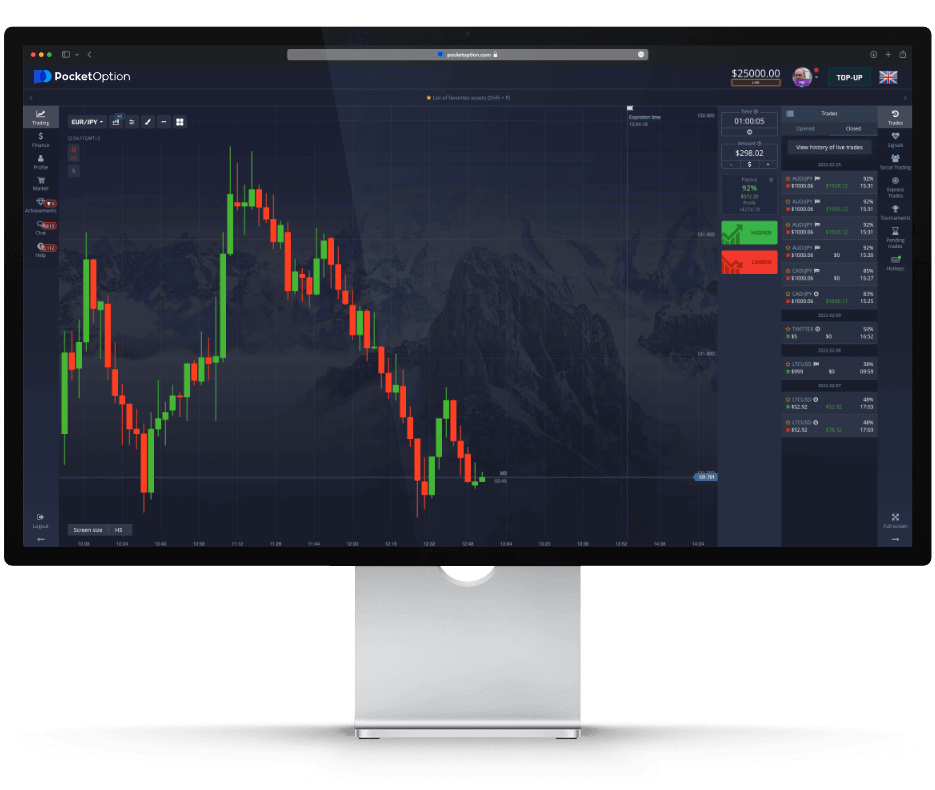

The world of online trading can be complex and challenging, particularly for new traders. Among the various tools available, pocket option indicators pocket option indicators play a crucial role in simplifying the analysis process by providing visual representations of market conditions. This article serves as a comprehensive guide to understanding and utilizing these indicators effectively.

What Are Pocket Option Indicators?

Pocket Option indicators are tools used by traders to analyze market trends and make informed trading decisions. These indicators derive from statistical data and provide insights about price movements, volatility, and market sentiment. They come in various forms, including oscillators, moving averages, and trend lines, each serving a unique purpose in trading strategies.

Types of Pocket Option Indicators

1. Moving Averages

Moving averages are one of the most fundamental indicators in trading. They smooth out price data by creating a constantly updated average price. Traders often use two types of moving averages: the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). The SMA calculates the average price over a specified number of periods, while the EMA gives more weight to the most recent prices, making it more responsive to current market conditions.

2. Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is typically used to identify overbought or oversold conditions in a market. When the RSI is above 70, the asset may be considered overbought; conversely, when it is below 30, it may be considered oversold. Traders often use the RSI in conjunction with other indicators to confirm trends.

3. Bollinger Bands

Bollinger Bands consist of a middle band (SMA) and two outer bands that represent standard deviations above and below the middle band. This indicator helps traders assess volatility in the market. When the bands contract, it signifies low volatility, while expansion indicates high volatility. Traders often look for price action near the outer bands as potential entry or exit points.

4. MACD (Moving Average Convergence Divergence)

The MACD is a versatile indicator that shows the relationship between two moving averages of a security’s price. It consists of the MACD line, signal line, and histogram. Traders interpret the MACD to spot possible trend changes and momentum. A bullish crossover occurs when the MACD line crosses above the signal line, while a bearish crossover occurs when it crosses below.

How to Use Pocket Option Indicators Effectively

While each indicator serves its purpose, combining multiple indicators can enhance trading strategies. Below are some guidelines on how to use pocket option indicators effectively:

1. Confirm Signals

Using a single indicator can lead to false signals. By combining indicators such as RSI and MACD, traders can cross-verify the strength of a trading signal, leading to more reliable decisions.

2. Understand Market Conditions

Different indicators perform better in different market conditions. For instance, trend indicators like moving averages work well in trending markets, while oscillators like RSI are better for ranging markets. Being aware of the market climate can help traders choose the right tools.

3. Set Clear Parameters

Define clear parameters for when to enter and exit trades based on the signals provided by indicators. For example, if using the RSI, a trader might decide to enter a trade when the RSI drops below 30 (oversold) and exit when it rises above 70 (overbought).

4. Stay Disciplined

Emotions can play a significant role in trading; therefore, it’s crucial to remain disciplined and stick to one’s trading plan. Relying on well-defined signals from indicators can help mitigate emotional trading decisions.

Common Mistakes to Avoid

Even experienced traders can fall prey to common pitfalls when using indicators. Here are a few mistakes to avoid:

1. Over-Reliance on Indicators

While indicators provide valuable insights, they should not be the sole basis for trading decisions. Always consider broader market trends, news, and economic factors.

2. Ignoring Time Frames

Indicators can produce different signals across various time frames. It’s essential to align the chosen time frame with the trading strategy, whether short-term scalping or long-term investing.

3. Lack of Backtesting

Before implementing a new strategy that incorporates pocket option indicators, backtest the strategy with historical data to evaluate its effectiveness. This practice can save traders from losses and refine their approach.

Conclusion

Pocket Option indicators are essential tools that empower traders to make informed decisions based on market analysis. By understanding the different types of indicators, how to use them effectively, and avoiding common mistakes, traders can enhance their chances of success in the trading arena. As with all trading strategies, continuous learning and practice are crucial to mastering the art of trading with indicators.