It is possible to Regulatory Alterations in 2019

Most recently, this new OCC made it clear it desires begin for the CRA reform from the issuing a heads up from Advised Rulemaking (ANPR) on late june 2018. A keen ANPR is not a certain proposition to switch the new CRA regulation, but alternatively contains a few questions having stakeholders to thought and address. The new answers to your ANPR next update any suggested alter in order to brand new CRA guidelines; new firms need certainly to up coming query individuals in order to comment on any advised changes prior to they feel final.

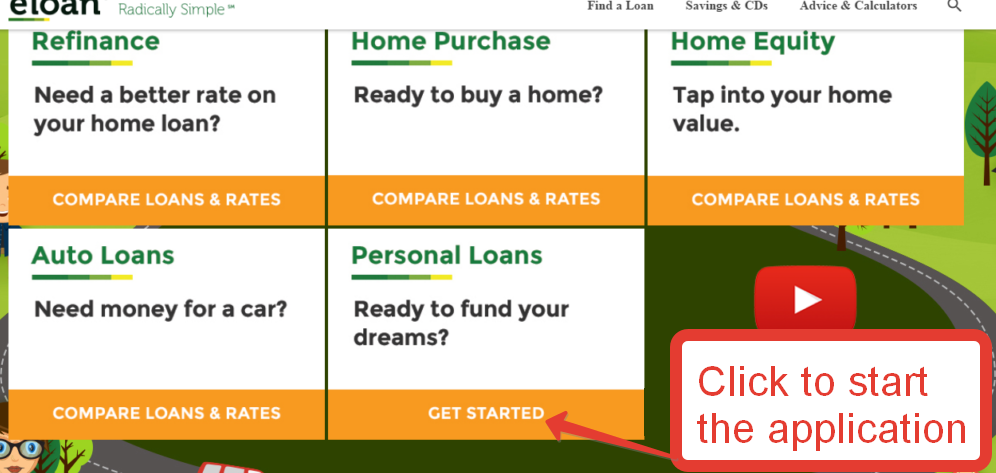

The banking surroundings have been through serious change as the Congress enacted the latest CRA during the 1977. You to definitely visible impact ‘s the internet sites therefore the supply away from financing and you will banking features via the internet. Even though many financial institutions nevertheless make the great majority of its finance thru twigs, enough latest finance companies and non-banking institutions operate mostly or exclusively over the internet. Because discussed a lot more than, inside Senator Proxmire’s day, new CRA hearings in it discussion away from how the CRA would measure the brand new overall performance of national and global financial institutions that take part in good-sized amount of organization past lender branches. These factors has prompted the brand new OCC to look at changing this new CRA legislation.

How can the fresh CRA effortlessly size whether or not such as for example banking institutions serve local organizations whenever CRA exams run geographic section with lender twigs?

Since genuine since the need should be revision the CRA guidelines, modifying the newest laws should be executed very carefully to hold Senator Proxmire’s work at local demands, answering LMI borrowers and you may communities, and you will prevention regarding credit allowance. Regarding ANPR, the latest OCC advertised a thought one turned aren’t known as that ratio. The main one ratio’s numerator certainly are the dollar quantity of CRA factors (loans, investments, and features) split by good bank’s buck number of possessions or another way of measuring lender resources. The fresh OCC was looking for a speed scale which will readily to make sure a lender it absolutely was during the compliance which have CRA. Unlike examiners expenses a lot of time figuring out in which a financial engages in business, a single ratio perform quickly just take CRA items as compared to financial tips.

The trouble towards you to ratio build is that they operates headlong into the desires of creating responsiveness to regional demands. Individuals localities prepared by a bank has actually some other needs; you to high-costs locality might have an affordable construction shortage whereas another s have independent assessments out-of show for localities you to definitely level responsiveness so you can requires such as for example sensible houses and occupations training toward underemployed. A-one proportion focused test, yet not, will get encourage the bank to respond to the will that is more comfortable for them and to skip need in other localities.

The one ratio is also contradictory with Senator Proxmire’s switch to the initial CRA statement. In reaction to help you inquiries off credit allocation, the Senator fell the requirement you to definitely finance companies suggest the latest proportion regarding financing in order to places it acceptance have been around in its top services components. Today, four years later, the newest OCC is actually considering a comparable ratio that would be an effective significant determinant off a great bank’s CRA get. This new OCC isnt necessarily proclaiming that the banks want hitting a certain proportion to Upper Witter Gulch loans bad credit pass, but may adopt criteria that would be ranges from proportion philosophy who would match some product reviews. Even selections, but not, you can expect to resemble credit allotment, particularly if the selections is inflexible and do not make up abrupt changes in economic conditions that make reaching them difficult. Also, in the 1977 hearings, one of several lenders, Todd Cooke, critiqued the initial importance of finance companies to suggest a ratio from money to help you places within number one services components towards factor that financial institutions could not effortlessly enjoy coming economic conditions.