Because of the Party at the Gustan Cho Couples becoming a zero overlay lender towards the regulators and FHA Finance, Mike is also design any sub-standard consumers files and help all of them qualify for a mortgage in just an effective short period of time

- step one. What is a zero Overlay Bank?A zero overlay bank strictly pursue might guidelines created by loan apps such as for example Virtual assistant Money Texas, FHA, USDA, otherwise Federal national mortgage association/Freddie Mac in the place of using most, significantly more strict conditions called overlays.’ These businesses bring a available road to homeownership, specifically for consumers that have down credit scores, high loans-to-earnings rates (DTI), or other tricky monetary circumstances.

- dos. Why are Virtual assistant Funds Tx Common Among Pros?Tx is among the quickest-growing states about U.S., drawing of numerous veterans because of its diverse job market, high quality of lives, and you can positive weather. The new interest in Virtual assistant Funds into the Texas is higher, with quite a few pros migrating from states eg Ca for taking virtue of one’s nation’s masters.

- step 3. Which are the Great things about Virtual assistant Mortgage brokers?Remember, Virtual assistant Home loans promote several positives, such as for instance not demanding an advance payment, providing down rates, maybe not mandating personal mortgage insurance policies (PMI), which have higher obligations-to-money thresholds, and you may allowing suppliers to cover closing costs. The key benefits of Va Mortgage brokers try appealing to qualified pros, active-obligation service players, and you can enduring spouses.

- cuatro. How come the brand new Texas Veterinarian Mortgage Differ from Virtual assistant Fund in the Tx?This new Texas Vet Mortgage, provided by brand new Colorado Experts House Board (VLB), is unique so you can Colorado pros, military participants, and their spouses. They often will bring down interest rates and can be taken having home sales, renovations, and you will residential property sales within Tx. Conversely, Virtual assistant Loans Tx, area of the Virtual assistant Mortgage brokers program, are available all over the country and include advantages for example no deposit and zero PMI. Veterans during the Colorado can be blend each other programs to maximize their advantages.

- 5. How come Colorado Not Enable it to be Va Dollars-Away Re-finance?Colorado enjoys unique home guarantee lending regulations, along with bucks-away refinancing limits to safeguard home owners out-of too much financial obligation and you may property foreclosure dangers. Such limitations, enshrined about Tx Composition, protect property owners off predatory credit practices and make certain they don’t sustain unmanageable economic burdens. When you’re Virtual assistant Fund Colorado limitations cash-aside refinances, homeowners can still access family collateral through other solutions instance home guarantee lines of credit (HELOCs) and you may household security loans.

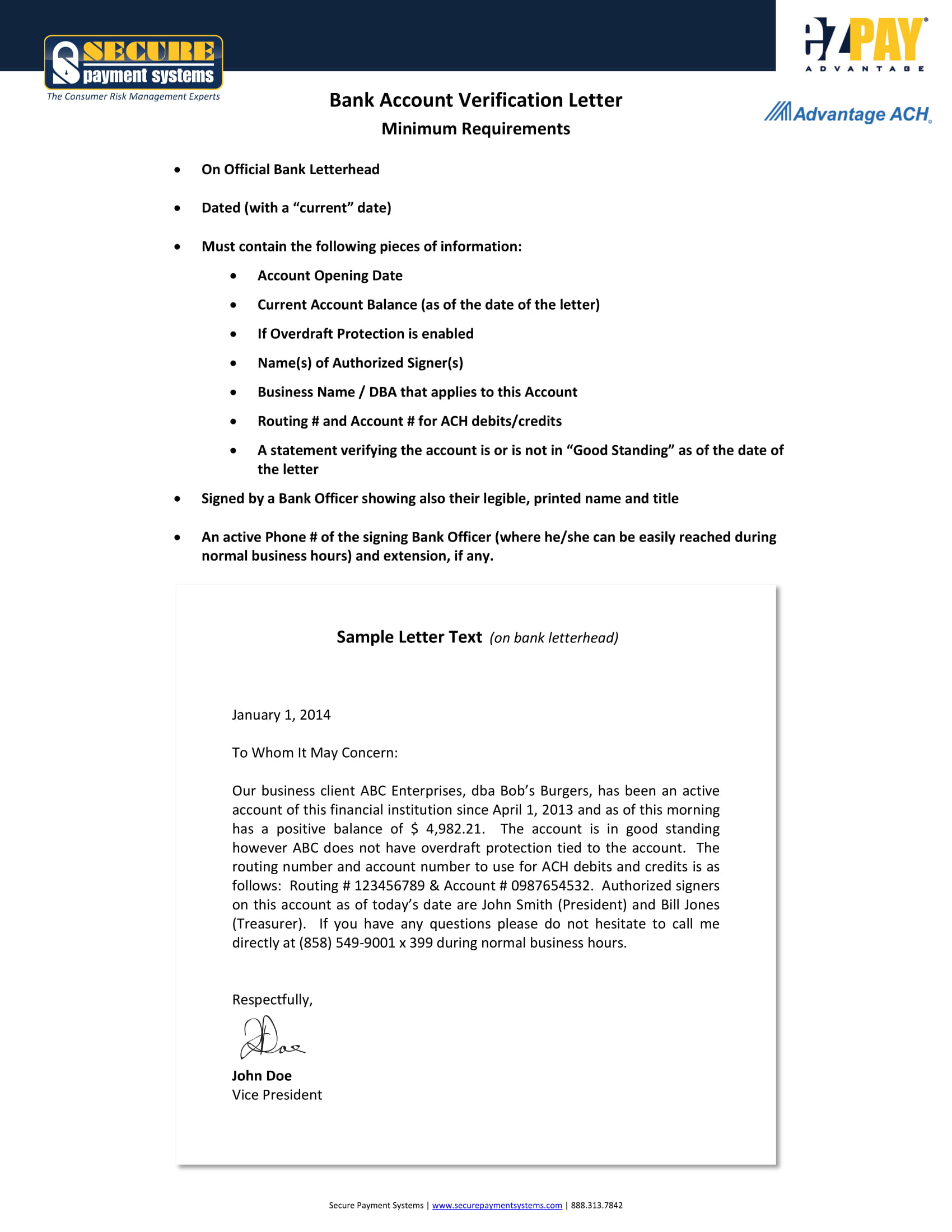

- 6. Exactly what Tips Ought i Sample See a Va Mortgage?To track down an excellent Va Financial, obtain your own Certification out-of Eligibility (COE). Next, gather support documents eg recent lender comments, pay stubs, W-2s, tax returns, and a national-given photos ID. Get in touch with a no-overlay bank such as for instance Gustan Cho Lovers getting a thorough pre-approval techniques, where a keen underwriter usually test thoroughly your records and point a loan commitment.

- 7. Can i Be eligible for a great Va Loan which have a minimal Credit Rating?You can qualify for an effective Virtual assistant Mortgage which have a decreased credit get. Of a lot lenders has actually overlays requiring highest credit ratings. Nevertheless, a zero overlay lender like Gustan Cho Partners follows the basic guidance of Va Lenders system, with no minimal credit history specifications. They concentrate on guidelines underwriting to help even more experts reach homeownership.

When you yourself have from the Va Money Texas or you to meet the requirements having Virtual assistant money that have a lender and no overlays, excite contact us during the 800-900-8569. Text us having a quicker impulse. Or email us at team during the Gustan Cho Lovers is readily available 7 days a week, into the evenings, vacations, and you can holidays.

Michael Gracz NMLS 1160212 try a seasoned mortgage manager that have Gustan Cho Couples Mike can help borrowers which have very poor borrowing and better personal debt to income ratios.

Considering the People within Gustan Cho Partners getting a no overlay lender on the bodies payday loan New London and FHA Money, Mike can also be construction people sub-standard consumers records which help them be eligible for a home loan within just an excellent short time

- Get in touch with Gustan Cho Associates

Even although you was indeed turned down to own a good Va mortgage prior to, definitely contact us. We could make it easier to reach finally your property goals! Consider most banks and you will financing institutions enjoys Bank OVERLAYS that stop borrowers’ approval. A lot of my personal clients was told they want good 620 or also good 640 credit history before they meet the requirements, That is not True. HUD doesn’t always have a credit rating dependence on Va loans, neither will we. I focus on guide underwriting Va Loans. I am always designed for you to-on-one to consultation services. We have aided of several Experts get themselves in addition to their group on the its fantasy house! Start building equity of your property today! Rating Be eligible for a mortgage which have financial and no overlays