That it text message may possibly not be within its last function that will become current or changed subsequently. Accuracy and you will availableness ming ‘s the songs checklist.

You can expect that financial pricing might be dropping nowadays following Federal Set-aside slashed rates of interest because of the half of a point history times. However, recently, mortgage rates popped higher, the help of its most significant increase given that sley, NPR’s personal loans correspondent. Hey, Laurel.

WAMSLEY: That is correct. New data from Freddie Mac showed that the typical 29-year home loan rates got risen up to 6.3% this week. Which is regarding the a quarter point higher than it absolutely was 2 weeks back. That is most likely an unwanted wonder to the people that are eventually coming off the sidelines to begin with interested in property. Why so is this going on? It is because mortgage costs are not tied to the Fed’s interest, but alternatively, it realize another type of count. They give for the a good ten-seasons treasury thread, which went high recently for a lot of grounds.

WAMSLEY: Zero, its determined by the brand new Fed, but it’s maybe not put because of the Fed. And also keep in mind that your neighborhood loan providers exactly who indeed make you the financial need coverage their costs and work out money, so that they incorporate their own commission at the top.

WAMSLEY: Sure, and is the big picture when planning on taking of so it however. Even with that it uptick, mortgage cost much more than simply the full area below they had been this time a year ago, and several everyone is taking advantage of one. They truly are refinancing its mortgage loans whenever they bought property on last couple of many years whenever cost was higher. The reduced cost mean they could probably rescue hundreds of dollars thirty days.

RASCOE: That payday loan Louisville it feels like mortgage costs are version of a moving address now. Can there be one feeling of where they’re going to settle? Which will be everything i actually want to understand. In which will they be heading?

WAMSLEY: All of us each other. Thus i posed that concern so you’re able to Lawrence Yun, the main economist from the Federal Organization of Real estate professionals, and you will this is what he said.

LAWRENCE YUN: I think new normal are six% home loan speed, hence we’re very alongside. Whenever we are lucky, perhaps we get in order to 5 step 1/dos percent mortgage speed.

WAMSLEY: Or we are able to be unlucky, the guy told you, together with price extends back up on the seven%. Which means this version of anticipating is tough, for even economists. But searching during the several forecasts, a lot of them has actually rates becoming a lot more than 6% from the stop regarding the year and you may dropping to help you on 5.8 the following year. If you carry out need it a home, you do not need to wait to see if cost have a tendency to lose ‘cause once they do, you could usually refinance in order to less price. However, if it rise, it simply becomes more complicated to cover the property.

RASCOE: Very mortgage cost ran up this week, no matter if rates of interest was straight down

WAMSLEY: Better, will still be a little early to inform, while the to order a house takes weeks out-of hunting to truly closure. But you will find some evidence that down prices is shaking things some time looser.

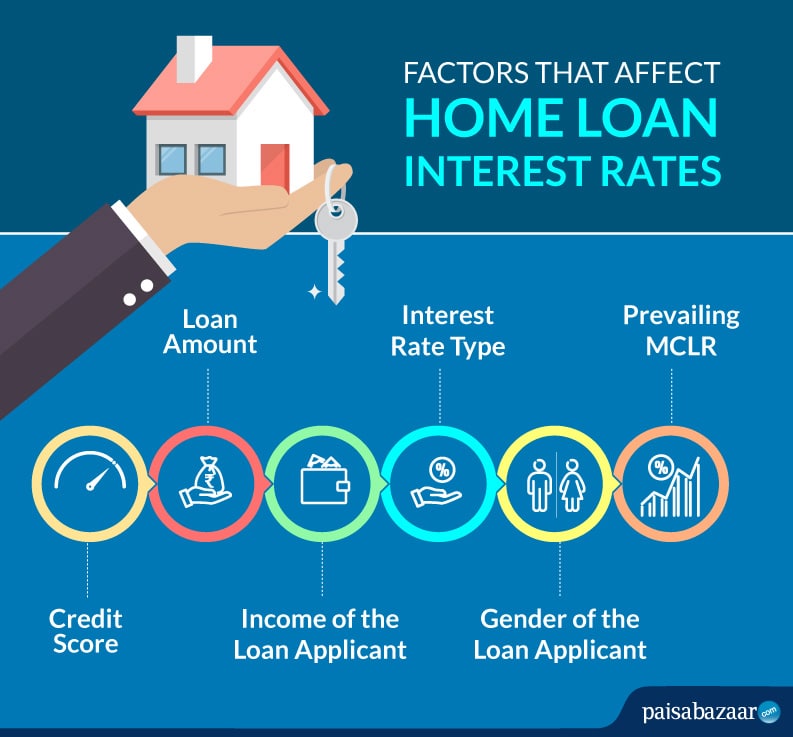

As well as the specific home loan speed that you would score is based yourself situations, like your credit history plus the dimensions and kind from financing that you are providing

WAMSLEY: Better, for-instance, more people is actually listing their homes available. You will find 23% a lot more present land in the market than just there were a year ago. And there is lots of the newest virginia homes, also. Which is really good development for buyers who possess perhaps not got far to choose from. And you will household sellers were homebuyers as well, thus the individuals group is going into the sector soon. And lots of suppliers have probably come waiting for mortgage costs so you can shed since it is difficult to throw in the towel new very-low cost that lots of closed in inside pandemic, whether or not these are generally outgrowing their current house. Right after which an alternative signal is that apps to have mortgage loans provides ticked right up some time, 8% higher than just last year, which also shows that more people are preparing to pick an effective home.