In the world of financial markets, forex trading signal Forex Vietnam is gaining popularity among both novice and experienced traders. One key element that significantly impacts trading success is the effective use of forex trading signals. These signals provide crucial insights and actionable data that can help traders make informed decisions. In this article, we will explore what forex trading signals are, their types, how to effectively use them, and the importance of choosing the right signal provider.

Understanding Forex Trading Signals

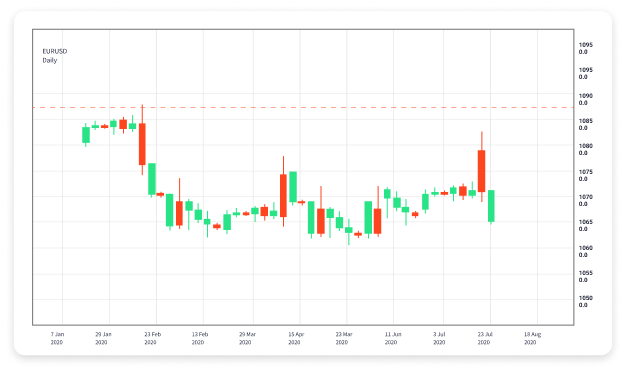

Forex trading signals are essentially notifications or alerts that indicate the ideal time to buy or sell a currency pair. These signals can be based on a variety of factors including technical analysis, fundamental analysis, or a combination of both. The aim is to provide traders with insights that can help maximize their returns and minimize potential losses.

Types of Forex Trading Signals

There are several types of forex trading signals that traders can use, and understanding each can help you choose the best approach for your trading strategy:

- Technical Signals: These signals are derived from chart patterns, indicators, and other statistical tools. Traders often use moving averages, Relative Strength Index (RSI), and Fibonacci retracement levels to generate signals based on historical price movements.

- Fundamental Signals: These signals are influenced by economic news releases and geopolitical events. Traders keep an eye on interest rate changes, employment rates, and other economic indicators that can impact currency values.

- Sentiment Signals: This type focuses on the overall sentiment of the market. By analyzing trader behavior and positioning, signals can indicate whether the market is leaning towards bullish or bearish trends.

- Automated Signals: These are generated by algorithms or trading robots which analyze data without human intervention. Automated signals are popular among traders who prefer a hands-off approach.

How to Use Forex Trading Signals Effectively

Utilizing forex trading signals effectively requires a strategic approach. Here are some tips to consider:

- Develop a Trading Plan: Before you start using trading signals, create a well-structured trading plan that defines your goals, risk tolerance, and strategies. This plan should integrate the use of signals as part of your overall trading approach.

- Analyze the Signals: Don’t just act on the signals blindly; conduct your own analysis to verify the information provided. This can help build your confidence in the signals.

- Keep Emotions in Check: Trading can be emotional, and it’s important not to let fear or greed dictate your decisions. Following your trading plan and respecting the signals is essential.

- Risk Management: Always use risk management techniques, such as setting stop-loss orders to limit potential losses. Proper position sizing should also be a priority.

- Continuously Learn: The forex market is dynamic and ever-changing. Continuously educate yourself on market trends, signal generation techniques, and various trading strategies to stay ahead of the curve.

Choosing a Reliable Forex Trading Signal Provider

One of the most crucial decisions a trader can make is choosing the right forex trading signal provider. Different providers offer various types of signals, and their effectiveness can vary greatly. Here are some factors to consider when selecting a provider:

- Track Record: Look for providers with a solid track record of success. Evaluate their historical performance to assess the accuracy and reliability of their signals.

- Transparency: Choose a provider that is transparent about their methods and performance. A good signal provider should be willing to share performance statistics and their methodology.

- Reviews and Recommendations: Research user reviews and recommendations from fellow traders. This can give you insights into the quality of the signals and customer service.

- Trial Period: Consider providers that offer a trial period. This allows you to test the signals without committing a significant amount of money upfront.

- Cost: While some signal providers charge high fees, others may offer reasonably priced options. Weigh the cost against the value provided to make an informed decision.

Conclusion

Forex trading signals are invaluable tools in the trading arsenal of both beginners and experts alike. By understanding the types of signals available, how to effectively use them, and how to choose the right provider, you can significantly enhance your trading outcomes. Remember that success in forex trading doesn’t come overnight; it’s a continuous journey of learning and adapting to market conditions. With the right approach and tools at your disposal, you can navigate the forex market with greater confidence and precision.

To boost your trading journey, consider the resources from Forex Vietnam and explore additional ways to refine your trading skills.