What things to Look out for in a Guarantor

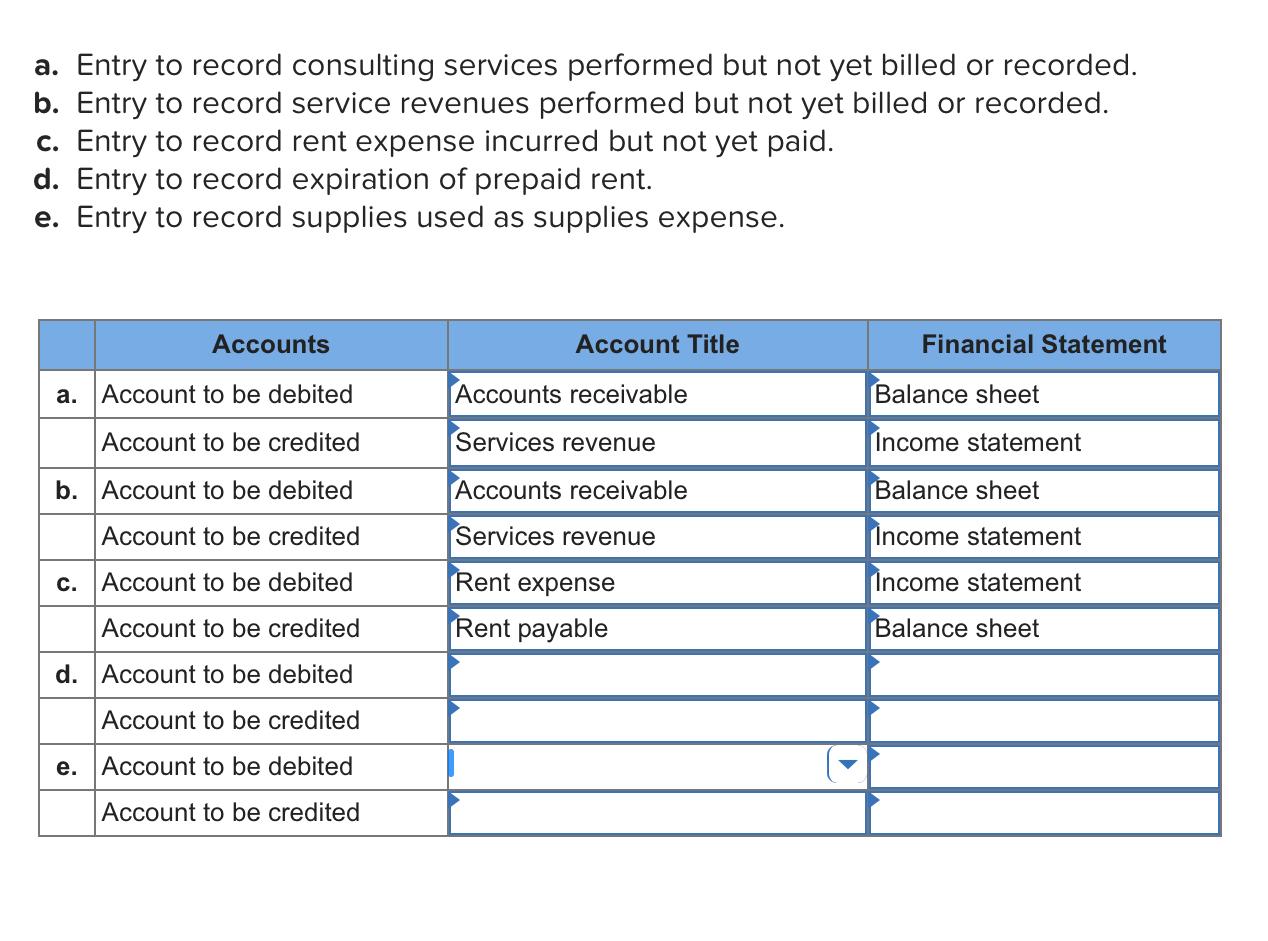

Good guarantor home loan is a kind of financial that uses an excellent guarantor to help you contain the home loan. It functions by helping create people that are usually troubled so you can safer a home loan (often thanks to an https://cashadvanceamerica.net/personal-loans-in/ undesirable credit score or any other financial reasons) properly get one to and you will probably improve the possibility of acquiring the mortgage at issue. It will it from the protecting the mortgage that have someone deemed financially secure sufficient to pay-off the borrowed funds if necessary [brand new guarantor] of course, if the fresh new debtor doesn't match otherwise entirely make their requisite money.

A guarantor financial is a fantastic opportinity for whoever has not even collected a mortgage-worthy credit score locate on the assets ladder. not, there are numerous different facets to adopt before-going finished with home financing that requires a guarantor to do something once the an additional level regarding promise towards shielded financing involved and satisfy the loan provider's mortgage underwriting procedure and you may policies.

In this portion, i establish what home financing guarantor is actually, the way it operates relating to United kingdom mortgage loans and lots of of your own most other aren't asked issues surrounding this material.

What's a home loan Guarantor?

A 'Mortgage Guarantor' is somebody who helps a frequently-battling mortgage debtor so you're able to even more properly sign up for a mortgage, earliest or possibly second fees mortgage in the uk. He or she is generally speaking sometimes a member of family, buddy, or companion which have a home loan-worthwhile credit history. Mortgage-worthy' typically refers to the guarantor becoming a person who have a tendency to features a financial background you to definitely mortgage lenders can find as the safer enough to provide a large amount of money to regarding variety of a home loan, particularly home financing, do it yourself mortgage or any other mortgage-related product. (さらに…)