Atiya Mahmood Environmental Build Condition Professional

In this case, you’re not alone. On a yearly basis, we purchase their first house and you will join the positions out of many Us americans who are already residents. For most people, to order a house is the biggest buy might previously build. Because it is a primary decision and requirements a number of relationship, you will be aware what is actually inside it and ways to browse courtesy the procedure off beginning to end.

This informative guide will help earliest-go out homeowners understand the property process. It will help you determine if debt resources will enable you buying a home, even offers advice for how to locate an appropriate house, and you can tells ways to get a home loan. Fundamentally, they guides you through the procedure for closure and suggests exactly how to safeguard disregard the.

Both to find and leasing a house have advantages and disadvantages. To begin with the home to acquire procedure, determine if the advantages of to shop for a home provide more benefits than advantages from continuous to rent.

For folks who have a robust need to very own their residence, are prepared to look after their house, and decide to live in the same region of no less than five years, to shop for a property is the right option for all of them, given he has adequate financial resources. To help you assess the annual can cost you out-of leasing and you may family control, fill in Worksheet step one to decide and therefore channel is perfect to have you at this time.

How much cash home do you afford?

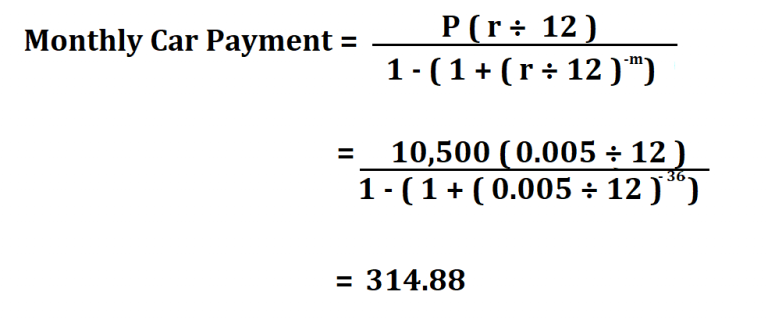

Purchasing a property can often be a pricey undertaking. Just about any homebuyer needs to money their particular domestic. It point will assist you to look at debt resources, help you imagine how big a loan you can purchase, explore multiple criteria you to loan providers look for in financial applicants, and you may define how to get preapproved and prequalified for a loan.

See your financial resources

To choose when you yourself have sufficient currency to buy a property, get a close look at the money. What kind of cash do you have stored? Exactly how much personal debt do you have? Worksheet 2 allows you to look at your current financial situation and you can decide how much money is readily available for the fresh new payment per month, deposit and you can closing costs.

How large financing are you willing to qualify for?

Numerous “recommendations” are often used to help anyone estimate how big mortgage in which they might meet the requirements.

- Loan providers will often be considered men and women to borrow between 2 and 2-1/twice the terrible yearly money. But not, understand that lenders are prepared to agree a beneficial huge mortgage than simply homeowners become they could conveniently afford otherwise wanted to imagine.

- Anyone should purchase no more than twenty-eight % of the gross month-to-month earnings to your houses costs. (Month-to-month houses expenses include the principal, notice, property fees, homeowners insurance and private mortgage insurance coverage, when needed).

- Month-to-month houses costs and other a lot of time-identity debts should not meet or exceed 36 percent off a good household’s gross month-to-month earnings.

The fresh new graph about Federal national mortgage association Base reveals the level of home loan where you might qualify, considering newest interest rates plus annual earnings. That it graph takes on you to definitely 25 % of the gross monthly money is put towards casing expenses, making three percent of one’s deductible twenty-eight percent getting fees and you may insurance. But not, which chart doesn’t simply take financial obligation and other issues into account, that can has actually a primary influence on the loan matter.

You are sure that your budget better than the financial institution does, and has actually month-to-month expenditures you to definitely a lender wouldn’t take into consideration. Hence, a different way to https://availableloan.net/loans/personal-loan-rates/ determine what size that loan you can afford would be to decide how much of your monthly income youre willing to assign to property costs (Worksheet step three).