House <a href="https://paydayloancolorado.net/mulford/">loans Mulford</a> Guarantee Financing Prices in Arkansas ()

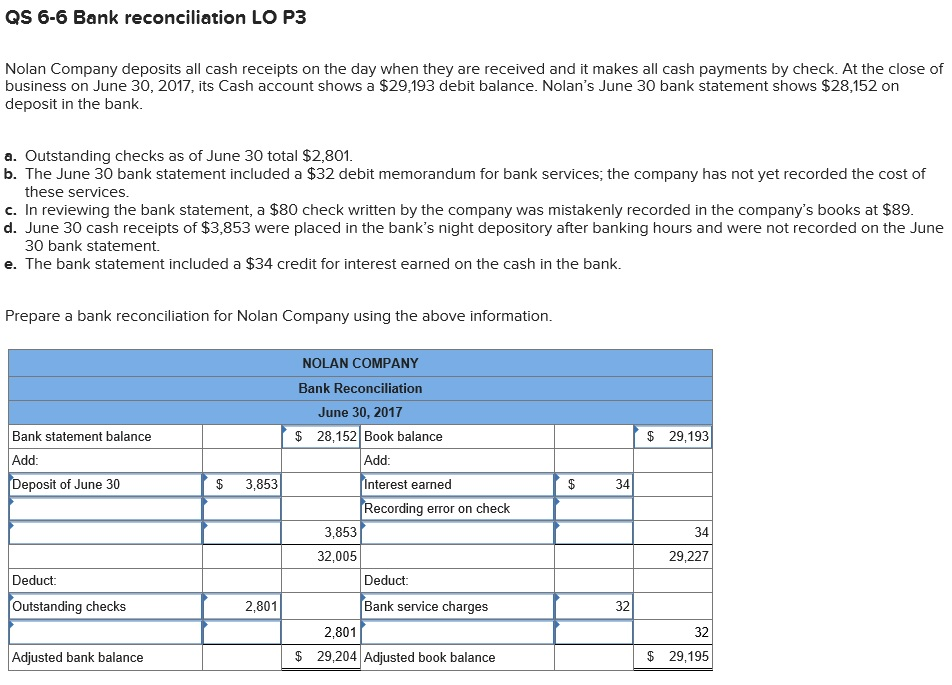

The current household guarantee financing rates during the Arkansas averages 8.3% to possess ten-seasons and you may 8.4% to own fifteen-seasons money, higher than this new federal pricing out-of eight.7% and you can seven.9%, correspondingly.

Of the Zachary Romeo, CBCA Analyzed of the Ramsey Coulter Modified by Nica Gonzales-Villaraza By Zachary Romeo, CBCA Analyzed by the Ramsey Coulter Modified by the Nica Gonzales-Villaraza In this article:

- Newest AR HEL Rates

- AR HEL Pricing by the LTV Proportion

- AR HEL Prices by Town

- AR HEL Loan providers

- The way to get an informed HEL Price

- FAQ

The security of your property that you can accessibility and obtain is known as tappable guarantee. A property guarantee financing (HEL) can help you optimize your house equity, whether you're trying money do-it-yourself ideas or combine personal debt.

Arkansas' house collateral loan rates is above national averages - 8.3% Apr to own good ten-12 months title (7.7% nationally) and you may 8.4% Annual percentage rate having an effective 15-seasons name (seven.9% nationally). We've built-up outlined knowledge with the newest home security loan rates during the Arkansas, in addition to town-particular cost, better lenders and tips on securing an informed pricing for making use of your own residence's collateral.

Secret Takeaways

High LTV ratios end in highest pricing. The average Annual percentage rate to possess an excellent 15-year HEL in the Arkansas that have a keen 80% LTV is actually 8.3%, compared to the 9.3% getting a 90% LTV.

HEL prices differ by town inside the Arkansas. Eg, for 15-season financing, McCrory provides the average Annual percentage rate of five.8%, whereas Hot Springs' try 10.0%.

Various other lenders promote varying prices for the very same loan items. (さらに…)